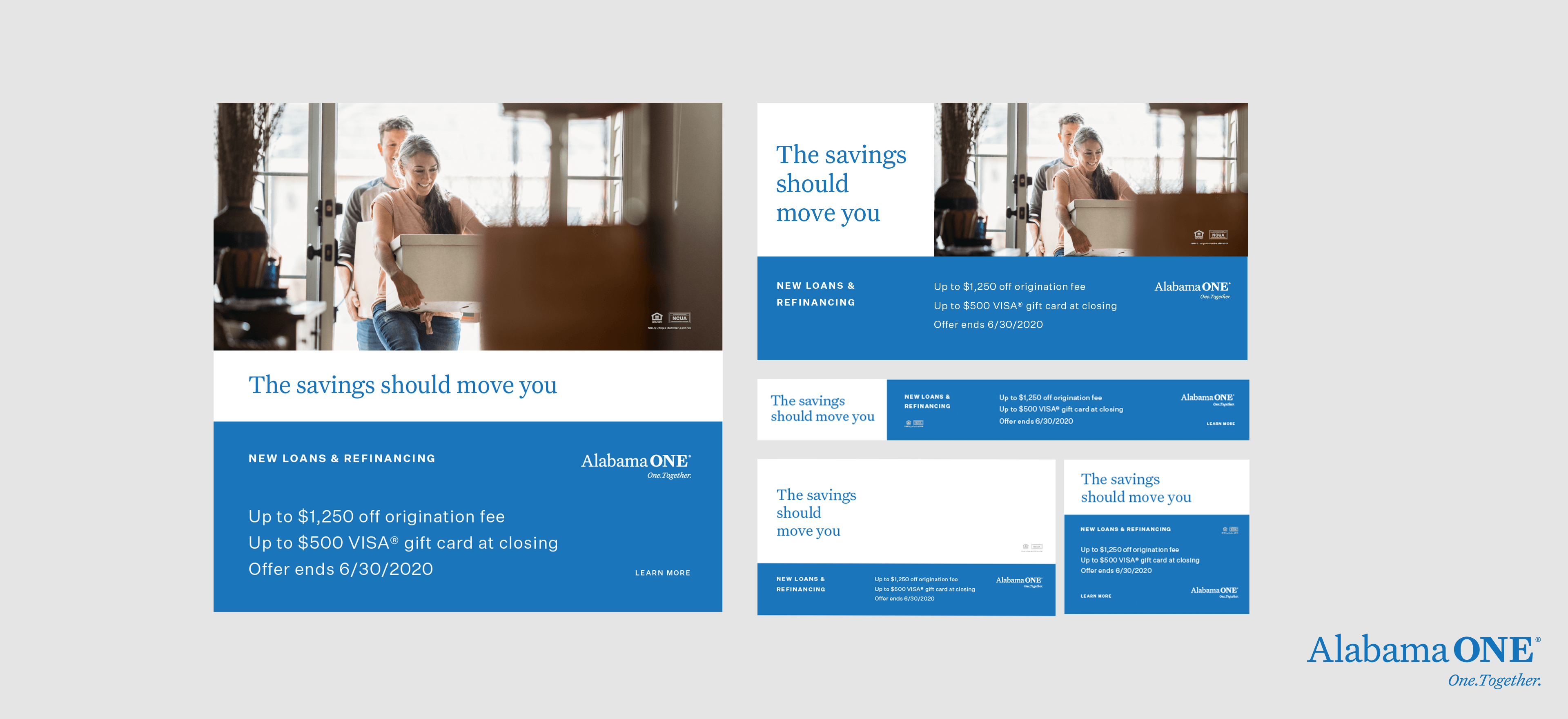

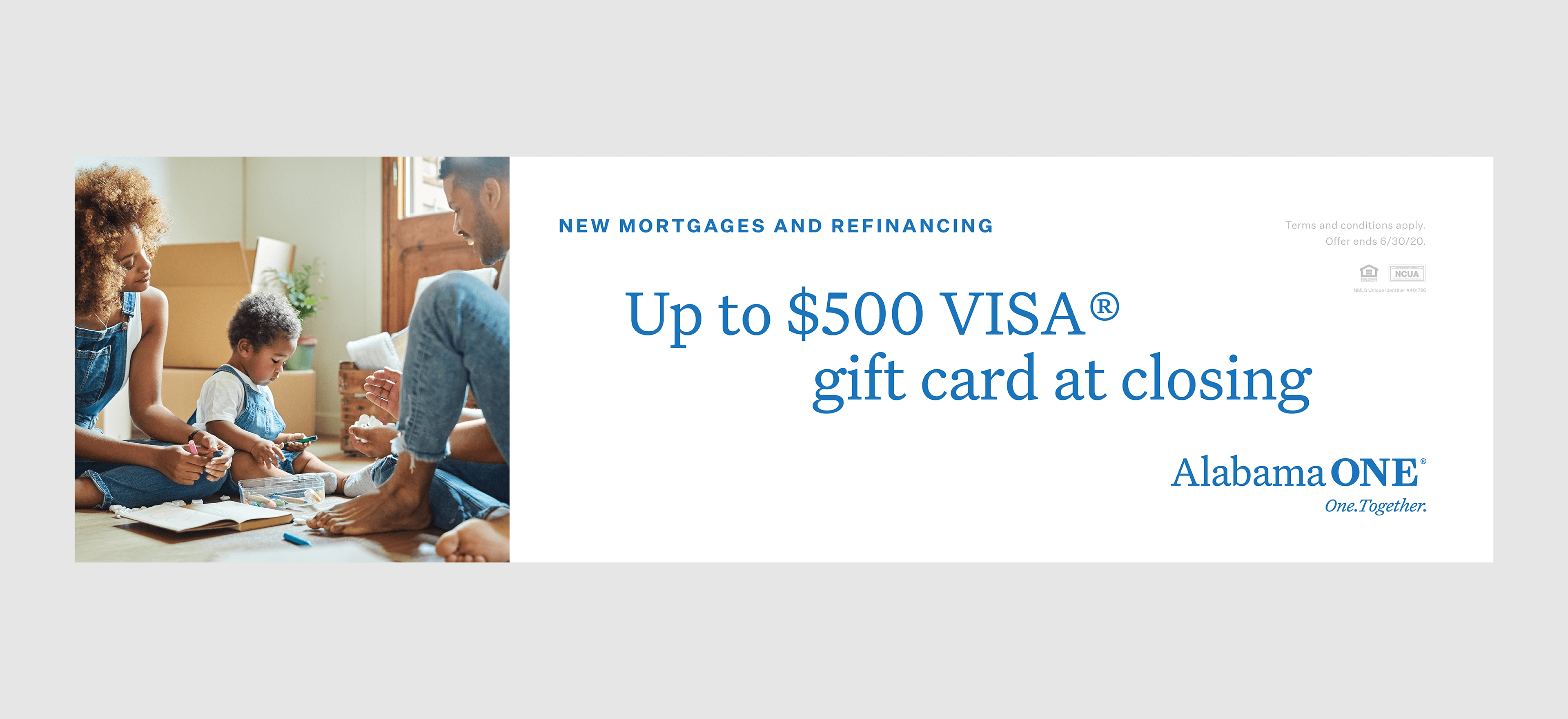

Alabama One Mortgage Campaign

Our first campaign provided a 30% lift in mortgage applications.

Case StudyAlabama One Mortgage Campaign

Industry

Financial Services

Conversion Point

Preparation to Action

The Challenge

Like most banks and credit unions, Alabama ONE runs regular quarterly promotions, featuring a different product or service. And like many other institutions, they had standardized the tactical tools used to communicate these promotions, with a heavy focus on traditional tools.

The tool that Alabama ONE had not leveraged was digital advertising.

As a result, their leads were often meager and attribution was non-existent.

Processes Used

Rational Re-Evaluation

Emotional Arousal

The Solution

One of our FitzMartin’s recommendations, when we began concepting and the design of their quarterly promotions, was to scale back traditional tools like outdoor and radio, and to invest heavily in digital media.

The initial campaign targeted both new homebuyers and people looking to refinance an existing mortgage. We implemented a variety of tactics , including website retargeting, lookalike audiences and member targeting on social media platforms.

These tactics drove 98% of web and mobile applications.

Results

In three short months, their mortgage applications increased by 32% over the previous year, with greater attribution, which allows Alabama ONE to refine future campaigns.